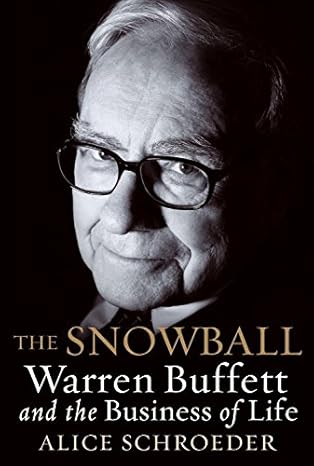

15 Lessons I Learned from Reading “The Snowball” by Alice Schroeder

A few years ago, I wanted to learn more about the old genius from Omaha. There is a sea of superficial content about Warren Buffett on the internet.

However, none of it does justice to the great man he became. The excellent book written by Alice Schroeder truly honors the Oracle of Omaha.

Several passages stood out to me, like his meeting with Charlie and his masterstroke with Coca-Cola. However, I’d like to bring the reader a few ideas from its more than 900 delightful pages.

Here is what I learned from the best living investor (at this moment).

1- In the short run, the market is a voting machine. In the long run, it is a weighing machine.

The last analysis I do in my investments is technical analysis. I used to be the guy who would put a thousand drawings and ten different indicators on my charts. What counts in the end is the consistency of your research and the investment you make.

2 – What you are doing when you invest money is postponing consumption to put money to work now. To get more money back in the future. There are only two questions: One is, how much will you get back? The other is, when?

Many people have the illusion that you just invest, and things will work themselves out in the future. But we’ve talked about inflation here. Will that money be worth the same amount?

3 – Rationality and honesty are a man’s greatest virtues.

We could talk about this for hours. Surely you’ve met many intelligent people who didn’t get results. Sometimes what’s missing is this rationality, this simple and direct way of doing things. It can simply mean keeping your feet on the ground. As for honesty… that comes from your upbringing.

4 – Protect your credit, for it is worth more than money.

When I read this book, I didn’t even have a credit card yet. My first one only came at the age of 28. Why? I understood this. Even if you don’t need the money, it’s always good to have one more option. Think about it.

5 – You shouldn’t bet on every race.

I have ten thousand. I allocate one thousand to each asset. As a result, I stay in the same place… neither richer nor poorer. I am “protecting” myself so much, even from the risk of profit. Make one good choice a year and follow it.

6 – Never stop learning. Never!

There are many ways to learn and many ways to turn that into wisdom. Choose yours. But always go to sleep smarter than you woke up.

7 – The margin of safety helps you sleep peacefully.

The greatest happiness in my investments has always been understanding that I could sleep calmly because I had bought something for $0.50 that was worth $1. The price? It only matters when I decide to buy or sell. Leave the price to those who trade every day. We seek value.

8 – Look for the details.

Details shouldn’t even be called details, they are so colossal. A comma, a digit, a single line can change history forever. We saw cases like IRBR3 and OIBR3 (at Brazil) in the past.

9 – Cultivate the habit of expecting the worst.

The motivational gurus and self-help crowd might faint at this one. But in short, it means to always prepare for the worst. If you are ready for the worst, the average and good scenarios are a piece of cake for you.

10 – His expenses were as close to zero as possible.

I have many people around me who haven’t even started making money with their business and are already buying equipment and subscribing to services, committing income that hasn’t even been created yet. Keep your cost of living as low as possible in this maturation phase of your investments. Then, give yourself an annual raise.

11 – We will not participate in businesses where the technologies are beyond my comprehension, as knowledge is crucial in any investment decision.

Warren was criticized for being conservative by not investing in technology over the years. He eventually did. But how many companies went broke? How many had subjective data? Only invest in something you truly understand. Otherwise, at the first sign of a crisis, you’ll jump ship and leave money for those who did their homework.

12 – If you were stranded on an island for 10 years, which stocks would you invest in before you left?

This is so powerful! Jesus taught in parables, and we can feel here that he made disciples… This has to do with perpetuity. Where would you put your money for 10 years without even looking at it?

Have you asked yourself this question today? Instead of jumping from one thing to the next, think about where you would invest this way and study the company in depth.

13 – Impatience is an enemy.

This is certainly the factor that has most affected me and affects millions of investors worldwide. News, apps, emails, social media posts. We are bombarded with notifications every minute, hour, day, and month.

Not looking at the damn stock price is challenging! And every brokerage makes money on commissions. Obviously, they will introduce tools to keep you as anxious and impatient as possible.

Advice: Uninstall all your finance apps. It will be strange at first; you’ll want to check quotes. But you’ll thank me later. If you believe in your investment thesis, what’s the need to check the price every hour? What has changed? Did a meteor hit the company’s headquarters? 🫨

14 – Ultimately, he who spends less than he earns is accumulating “deposit slips” for the future.

Giving up small pleasures and luxuries today to collect dividends tomorrow. There’s no mystery. It’s not rocket science. I recommend reading “The Richest Man in Babylon.” It’s simple, practical, and objective.

If you understand the basic concept of that book, you don’t need advice from a coach, a book, a spreadsheet, or any of that nonsense sold on the internet.

15 – No one can do well in investing unless they think independently.

My apologies to the “trading clubs,” but it is scientifically proven that groups influence individual decisions.1

If you are going to win in this market, it has to be your way. If you lose, that’s on you too. No outsourcing blame to an indicator, the market, the brokerage, the president, the economy, blah blah blah.

Study, study, study, learn to analyze on your own, and understand the risk-return relationship. If you are patient and do your homework, Mr. Market will eventually concede.

Final Tip – In a crisis, the combination of cash and courage is priceless.

This is like Bitcoin in 2009 when you could buy 100 units for $1. Folks, I made the largest sums of money in my life (so far) during crises: Dilma, Brumadinho, and COVID. Think carefully: what are the economic elements of a crisis? Where do we stand now? Stay calm and aware. Although it may not seem like it, crises often “emerge right under our noses.”

Concluding Thoughts

I have brought you the most relevant ideas and excerpts that I enjoyed. The book is well worth reading; it’s a real delight. Its size becomes unnoticeable once you start reading. 10/10. I have a habit of making summary cards for the books I read. It’s a valuable practice that helps to memorize information well.

Even though I read it 5 years ago, as I was writing this text for you, I started remembering the details, and a sense of nostalgia emerged.

And old Buffett? He really is spectacular! His work will surely be recorded in human history. However, I emphasize: do not compare yourself to him, do not try to imitate him. He was born, lived, and grew up in another era, with different opportunities. The world has changed a lot. Some of his principles still work, but the market is and always will be in motion. Update yourself, keep moving. See you soon!

- https://en.wikipedia.org/wiki/Milgram_experiment ↩︎