The Best Stocks for October 2025

Every month, we present a selection of promising assets. Our analysis of the best stocks for October 2025 is now available.

October marks not only Children’s Day in Brazil but also the beginning of the home stretch for the final quarter of the year. During this period, companies strive to present solid numbers on their December balance sheets.

This can generate interesting opportunities in the market. Let’s analyze together some of the best options for the coming month.

Our Selection Method

First and foremost, it’s worth noting that our strategy seeks assets that are temporarily undervalued but possess solid intrinsic value.

Our goal is to identify value where the market hasn’t yet noticed it, focusing on companies that exhibit the ideal combination of:

- Controlled debt;

- Robust cash flow;

- Consistent revenue generation;

- Healthy net profit margins.

After all, what’s the use of a complex analysis of multiple indicators if the company doesn’t generate a profit? With rare exceptions, such as early-stage growth companies (like Tesla and Figma in their expansion phases), this premise is fundamental for perennial and established companies.

Best Assets for October 2025

1 – AZUL4 (Azul Airlines)

About: Azul (AZUL4) has consistently stood out in our analysis filters. We recently wrote a detailed article about the company [at this link].

In summary, the company holds the largest airline network in the country, connecting Brazil from North to South with its vast fleet of aircraft.

Why we consider it an opportunity?

The company has undergone a financial restructuring process. Despite its debt, we believe the strength of its assets can serve as collateral for debt renegotiation. This could allow the company to overcome this challenging period, secure new credit, pay its creditors, and maintain operational stability.

2 – ISAE4 (ISA CTEEP)

About: ISA CTEEP is one of the most interesting companies we have studied recently. You can understand in detail why we see so much value in it [here].

It’s not every day you find an electric power transmission company with such solid fundamentals. Operating in one of the most resilient sectors of the economy, it’s worth watching closely.

Why we consider it an opportunity?

ISAE4 is financially very stable and is part of a perennial sector in Brazil. Its long-term concession contracts make its revenue highly predictable, a key differentiator for investors.

3 – ALOS3 (Allos)

About: A recurring highlight in our analyses, Allos (formerly Aliansce Sonae) has been appearing in our filters for almost a year. We have mentioned the company [here], [here], and [here].

Allos operates in an interesting economic sector (shopping centers), which depends on the right “timing” to maximize its results—something its management has been doing competently.

Why we consider it an opportunity?

The company has a robust and well-structured business model, which is reflected in its financials. It boasts one of the strongest balance sheets on the B3 stock exchange. Currently, its market value is approximately half the value of its assets, an indicator that draws attention, especially since it has no long-term debt pressuring its cash flow. A perfect 10!

4 – RECV3 (PetroRecôncavo)

About: PetroRecôncavo is an interesting case. We have recommended analyzing the company [here] and [here], and since then, its share price has continued to decline.

The company is in the oil sector, a segment heavily influenced by global geopolitical factors.

Why we consider it an opportunity?

The company operates in oil exploration, has efficient management, and shows formidable numbers. An analysis of its fundamentals reveals an impressive balance sheet. The continuous drop in its stock price, despite its operational quality, could represent an excellent opportunity to reap rewards in the future. Its market cap of BRL 3.8 billion is almost half the value of its assets, with controlled debt, strong revenue generation, and stable profit.

5 – USDBRL (U.S. Dollar)

About: Every day, inflation erodes our purchasing power. The feeling of going to the supermarket and seeing the shopping cart get emptier is a reality for many.

That’s why we wrote [this guide]. We see the dollar as much more than a simple store of value; today, holding a portion of one’s assets in dollars is a strategic necessity. Depending exclusively on the Brazilian Real for retirement can be risky in the long run.

Why we consider it an opportunity?

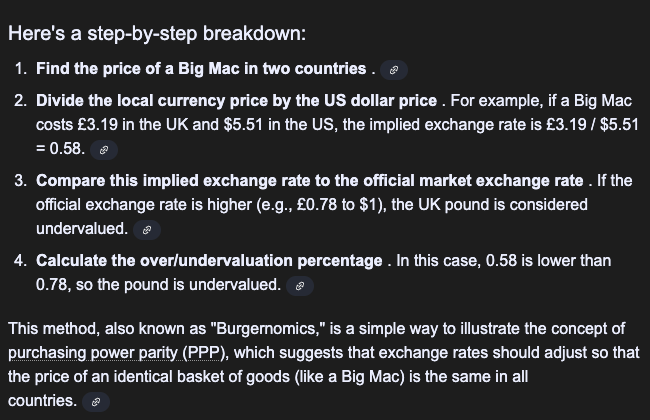

The dollar has been trading at interesting price levels. However, these levels may not fully reflect the challenges and uncertainties of the Brazilian economy. Using the Big Mac Index as an informal measure of purchasing power, we notice a significant disparity.

This could be a good time to strengthen your store of value in a strong currency.

6 – BTCUSD (Bitcoin)

About: Created in 2009 by an anonymous figure known as Satoshi Nakamoto, Bitcoin has established itself as the world’s most famous cryptocurrency, often called “digital gold” for its function as a store of value.

Its unique characteristics, such as decentralization, divisibility, and portability, make it a unique asset in the internet age.

Why we consider it an opportunity?

You can read [here] why we consider Bitcoin a valuable asset. The recent correction in its price could represent a window of opportunity to accumulate the cryptocurrency (or fractions of it, known as “Satoshis”).

7 – BCS (Barclays PLC)

About: Barclays is one of the largest banks in the United Kingdom and a globally significant financial institution with operations in many countries and a wide range of financial products and services.

Why we consider it an opportunity?

Barclays has appeared in our analyses [here] and [here] at similar times. Our filter seeks assets with high appreciation potential that are currently undervalued. Despite its recent rally, we believe BCS still has a lot of value to unlock, and we are focused on that potential.

8 – CIVI (Civitas Resources)

About: Civitas Resources is a company that acquires, develops, and explores oil and natural gas fields in the United States. It has appeared in our filters before ([here] and [here]).

Why we consider it an opportunity?

The current outlook for the oil sector faces challenges, as we have detailed [here]. The stock is trading near an important moving average. However, its intrinsic value and its ability to generate recurring profit keep us optimistic about a probable appreciation.

9 – CMRE (Costamare Inc.)

About: Costamare is an international holding company based in Monaco, a leader in the maritime shipping industry, focusing on chartering container ships. It was founded in 1974 by Konstantinos Vassilios.

Why we consider it an opportunity?

A quick look at the chart already shows its operational quality. The company’s fundamentals are solid and aligned with market expectations. With a great deal of intrinsic value to deliver, we believe that breaking the $13 barrier could unlock unique potential for this asset.

10 – GPN (Global Payments Inc.)

About: Global Payments is an American payment technology and software company. It primarily offers solutions for small and medium-sized businesses in a highly competitive sector that includes banks, Stripe, PayPal, and more recently, cryptocurrencies.

Why we consider it an opportunity?

The company is facing a tough time with its stock price, which doesn’t seem to reflect its true value. We note that the asset is trading within a consolidation channel between $85 and $87. What strikes us most is its financial quality and how it has overcome challenges to continue its growth.

Bonus – GSL (Global Ship Lease, Inc.)

About: Global Ship Lease is a containership owner with a focus on maritime transport.

Why we consider it an opportunity?

The company is in an interesting upward channel, and its multiples signal an attractive valuation. Furthermore, we highlight its excellent profit margins and strong cash flow generation.

Final Thoughts

We have reached the end of our analysis. The stocks and assets for October 2025 were selected after careful consideration and, in our view, represent interesting opportunities.

However, it is crucial to remember that all investments involve risks. Conduct your own analysis (DYOR – Do Your Own Research) and assess whether these assets align with your investor profile and strategy.

All the best and see you next time.

The Threedolar Team.

Disclaimer

This content is for purely educational and informational purposes. Nothing written here should be considered a recommendation to buy or sell assets. Past performance does not guarantee future results. The responsibility for your investment decisions is exclusively yours.

FAQ

What are the best stocks to invest in for October 2025?

While major banks and analysts often focus on names like Itaú, Petrobras, and Vale, this article presents our particular selection of assets that we see as having good potential for the month.

Which companies are paying dividends in October 2025?

Several companies distribute dividends in October.

About Us

Passionate about investments and the transformation they can bring, the Threedolar team is dedicated to demystifying the financial world and guiding its readers toward financial independence. We believe that knowledge is the key to investment success.