How to Self-Custody Cryptocurrencies in Practice

The cryptocurrency universe is vast, but quality information about self-custody is rare. In my 13-year journey, I realized that many guides are generic, written by those who haven’t experienced the anguish of a hack or the loss of keys. Therefore, I decided to write this self-custody guide for Bitcoin and cryptocurrencies

This is not just another one of those texts. This is a practical guide, forged in real experience, where I will dedicate myself to being direct and in-depth, so that you, dear reader, can protect your digital assets with security and confidence.

Index

Risks

I’m a Reddit enthusiast and we even have a sub there. Every day I go through the subs and identify beginners who haven’t yet been initiated into the cryptocurrency process. Partially because they don’t want to make the effort to read the books. Partially because there’s so much information about cryptocurrencies nowadays that it’s hard to know who’s telling the truth.

It’s always like this: John Doe has a problem, Richard Roe has a solution, Jane Doe has a counter-argument, and then the loudmouth comes along and ridicules John Doe’s doubt and Richard Roe’s solution. Thus generating more doubt and distrust. That’s why we’re always at this standstill.

Everyone “knows a lot” and yet. They do very little about it.

Therefore, one of the most primary errors I frequently read about is the eternal doubt of whether or not to leave money on an exchange. And the most coherent answer to this is: **It Depends**!

It depends because leaving or not leaving money on an exchange is according to your goals, the amount of money available, and how comfortable you are taking that risk. There is a lot of FOMO in the cryptocurrency market. Precisely because people don’t understand the basics.

So, I recommend: Bitcoin Red Pill and The Bitcoin Standard.

To conclude this first part. We have to talk about money itself. And, money is one of, if not the most sensitive subject in our civilization. Regardless of the amount. It is important because it buys resources, time, and access.

But, I see people who invest small sums taking precautions as if they were ex-KGB agents, gangsters, or mobsters involved in complex systems. And well. That’s not the case for the vast majority…

The vast majority work, study, save, and want to invest a portion every month. But this amount of detail they want to follow severely hinders the cryptocurrency adoption process. Study the basics, keep it simple, and continue reading this manual here, and everything will be resolved.

Exchange Risks

KYC – Know Your Customer

First, we have to say that the biggest risk of using exchanges is this. If you have a photo of yourself circulating on the internet, if you have an Apple or Google account, if you have any online record. **Know that the government is already monitoring you**. Period. You just don’t make a difference to them, yet…Yet…

However, getting crazy about hiding your identity is madness. If you don’t want to be registered on the internet. Don’t use it. Even if you try, you’ll fail miserably when you need to use Google Maps…

When you have time, watch this and you’ll realize that it’s difficult to be anonymous

Therefore, in my opinion, this is the biggest risk of using an exchange. You hand over your documents, your photo, your face, and link your life to them.

Have you noticed that every time you log in, some exchanges and banks confirm with a photo of you. Imagine, why do they do that?

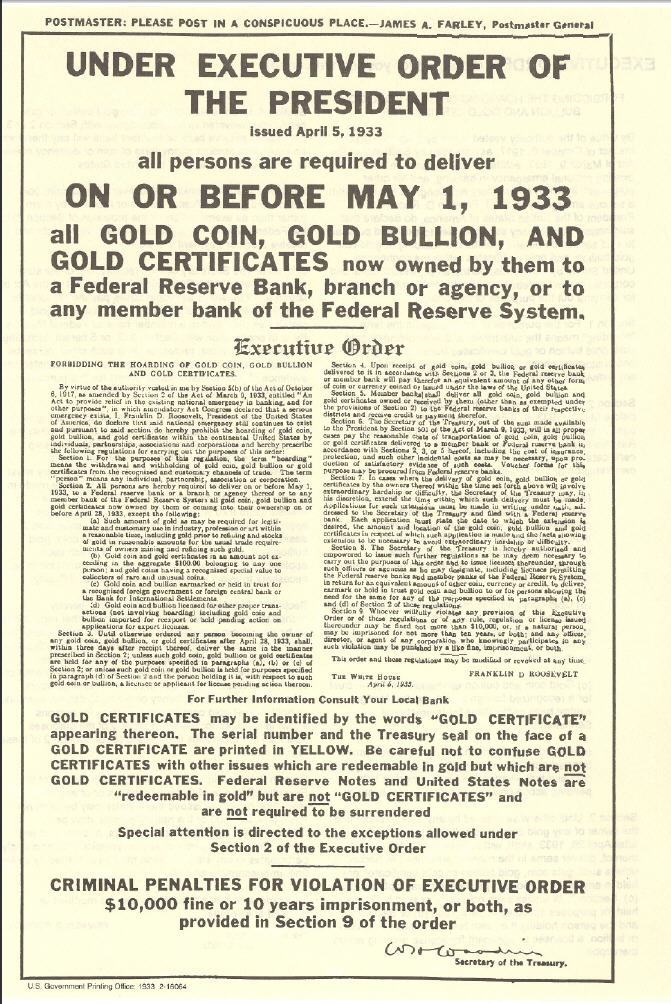

The whole problem lies in something happening like what happened in the US, during the Executive Order 6102. For those unaware of what this is. This was a moment in US history when President Roosevelt ordered the forced seizure of all circulating gold to accumulate reserves for printing more fiat currency.

In short. Know that officials had orders and the power to invade the homes of ordinary citizens and confiscate all gold found. Billions were retained. This was in 1933, 92 years ago. What prevents it from happening again?

When you give your identity and reveal your movement of money into cryptocurrency. You give up your impartiality and your key phrases may be at risk, under government surveillance.

The issue is, that you are not relevant to them.. And to the government. Just another nerd, moving small amounts. That is, until they need you…

That’s why I call everyone’s attention to transact their cryptocurrencies without KYC,1 as this can and should affect you in the future.

We don’t know if we will have another Executive Order 6102 or if the government will impose more taxes on those who own cryptocurrencies. So, if this happens and you raise your hand. The entire meaning and purpose of cryptocurrencies and Bitcoin will be lost.

Be that as it may, by learning the basics about cryptocurrencies and Bitcoin. You will empower yourself so that, if at any time. Episodes like this occur, they will not affect you.. Your mind and the security of your assets. Will be shielded.

Defaults

Furthermore, let’s remember the case of the FTX exchange of Sam Bankman which was the most famous case of all recently.

In November 2022, amidst accusations of fraud. Due to lack of liquidity for positions. When Binance CEO Changpeng Zhao decided to liquidate his FTT position (FTX’s cryptocurrency), the entire market followed, and there was no way out.

25 little years in jail for Sam Altman, closed company, and billions of dollars in losses. A lot of people were left empty-handed at that time. A similar case happened with Robinhood and the Gamestop case too. During the margin call, the brokerage lacked liquidity and froze customer funds. This was the subject of the excellent movie later produced.

And don’t think we’re done here. We have more cases, which are in the recent past:

And so on…

By the way, we are talking about the big fish from the recent past. But, in the beginning. How many companies simply “evaporated” overnight?

I myself had mining contracts with two companies in 2018. After waking up from a revitalizing eight-hour sleep. I grabbed my cell phone and…

Upon trying to access the website. It was simply listed as down. I waited a few hours for it to come back, waited a few days, and I’m still waiting today.

Some other risks to consider:

- Hacker attack.

- Limitation on your assets.

- Government regulations.

- Loss of account access.

Returns – Inheritance and control of your assets

Once the risks are understood, it’s time to understand what advantage you gain in the long run by adopting these protection measures.

Total Control

This is by far the biggest benefit of self-custodying cryptocurrencies. Choosing to whom, where, when, and how much of your cryptocurrencies you want to send. This is the best feeling in the world. You have much more power over your money.

In contrast, go to the bank and ask your manager to withdraw ten thousand reais in cash, just so you can feel the size of the bureaucracy involved and the frustration….

“- It’s for your own good, for your security!”

Currently, we all know that banks use our deposited money there. As collateral to make loans of all types, flavors, and tastes. In exchange for immense interest rates accompanied by a handful of fine print at the bottom of the contracts.

Anonymity

Once in possession of your key phrases. You will be able to send values to whoever you want without needing to identify yourself. For example, here in Brazil. We have the PIX system. If you bought a yogurt or paid for gasoline. Everything is registered on the government’s blockchain.

And it gets worse…

However, anyone who believes this started with PIX is mistaken. Our government has been tracking us for a long time. The PhD professor in economics can explain better than me how this process has been happening.

Your money crosses borders

Similarly, think about the situation of Ukrainians, Syrians, and the people of the Gaza Strip. Your life can change overnight. With a simple decision by some suit sitting at a table.

Literally, you can go from the wonderful luxury and comfort of reading this text on your cell phone lying in bed, eating some snacks, and drinking a cold soda. To a situation of not having drinking water, sewage, and access to the supermarket.

Think about the number of foreigners who were forced to migrate because of wars and conflicts that the high command decided to enter or create?

Many of them left billions of dollars behind. Because there was no possibility of withdrawing the money, transferring the money (in conflicts, one thing to be cut as a priority is communication means), or even taking valuable sums and objects with them; as they would be easily confiscated or stolen during the crossing.

What could be easier to carry than 12 or 24 words? Literally, you can move billions with 12/24 seed words. You don’t even need your cold wallet. In fact, in a situation like this. It is important to break it and make it disappear into pieces.

How many resources could still be in the hands of honest and hardworking people? Who just wanted to live their lives?

Think about this when calculating and deciding to leave 100% of your money in a national bank. And worse. Leaving 100% of the money there digitally. Where your control is as close to zero as possible.

Responsibilities – Backups, key phrases and storage

Okay, now that you understand the risks and rewards of self-custody. Let’s talk about something that needs to be addressed. **Your responsibilities**.

First of all, I know what you might be thinking. But the truth is. Not everyone is ready to have total control of their money. If you. Just like me, came from simple origins. You have certainly seen workers with problems with: Alcohol, cigarettes, drugs, and now, gambling…

So, first and foremost. Let’s be modest about this cryptocurrency universe. And please. Don’t be a cryptocurrency lunatic and at the same time try not to enter into ethical or philosophical debates about them.

Simply, do your thing. Take care of your own and don’t hold anyone back.

If some people in your circle show interest. Okay. Send them this text (Just kidding!). Otherwise. Don’t become the guy who only talks about it and lives for it. There’s a lot of life out there.

And this is a sensitive subject. As much as the crypto community doesn’t like to admit it. We are far from mass adoption at this moment. Therefore, we need to evangelize gradually. In groups, raise awareness, and spread the word gradually.

Let’s talk about backups

Many people on social media have doubts about this topic. Even more people theorize crazy things that I honestly can’t figure out where they get them from… Risk of quantum attack, risk of losing the words, risk of your house catching fire, risk of someone kidnapping you and forcing you to hand over the words. Anyway, risk of this and that.

Let’s be honest. For something like that to happen, you weren’t at church…

You did something and were exposed. The truth must be told.

No one in their right mind who has 50-100% of their assets in cryptocurrencies or bitcoin. Is going to post on social media showing their face, wallet, and balance. Saying that they have one to two hundred thousand dollars in cryptocurrencies yielding and paying for the champagne they are drinking.

3 basic rules for you, young jedi:

- Never tell anyone about your cryptocurrencies.

- Never tell anyone about your cryptocurrencies.

- Never tell anyone about your cryptocurrencies.

Got it? Good! We never come back here.

If you have common sense, you understood what I said.

Now, if you invest small amounts. Are learning, this value does not reach 10% of your assets. It’s okay for you to talk more openly about it. As long as it’s anonymously and without saying how much you have. Reddit is great for this.

But for heaven’s sake. Enough with these anxieties… The guy activates the VPN, uses a private email, and enters the exchange that identifies him by capturing a photo of his face! Ahhhhhhhhh. Help me help you.

Another anxiety I read every week is: The user activates the VPN, uses a private email, uses a non-KYC exchange, sends to the cold wallet the paltry sum of… R$100🤡. Then goes to groups and forums to ask what happens if the Federal Revenue investigates his transaction because it is recorded on the blockchain.

My friend! My friend! My friend!

I think, I imagine, I suspect, I have the slight feeling that the Federal Revenue has more important things to do.

Use a non-KYC exchange and take care of your key phrases. Done!

Here is the list of recommended exchanges:

Key Phrases

12, 24, or 48 words? Which is better?

Undeniably, we could spend days here discussing cryptography. You can read about it here and here to better understand.

But in practical terms. Each digit added to a binary number is double the number. If you use 12 words, it’s 126 bits of encryption. If you use 24 words, it’s 256 bits.

Risk? More words to deal with when storing and losing. Reward? Greater security and difficulty in a potential quantum attack on your hard-earned money.

Is it worth it? It depends. You decide. Let’s put a line under this topic and move forward.

Passphrase

You can also use passphrases as a way to secure your assets. They function like passwords.

However, you should focus on the **length** of the phrase and the **use of special characters** in it. Thus making access difficult through computational brute force attacks and/or hack and phishing attempts2.

The main advantage of using it is how much more complex your password becomes.

4 key words in a 7,000 word dictionary would be:

(7,000 x 7,000 x 7,000 x 7,000) = 2.401 × 10¹⁵ I don’t even know how to write the result out.

✅Use 4 to 6 **random** and **unrelated** words.

But remember. If, by chance, you lose this phrase. Say goodbye to the sum. You will hardly be able to recover your funds.

Storage

In contrast, let’s talk about the most vital topic regarding self-custody. Where are you going to keep the darn key phrases?

Online? Forget it.

With a friend? Maybe.

Writing it down on your dog’s collar? You’d have to be brave.

Metal plate? Why not?

Putting it inside your house wall? That’s crazy man!

Many hypotheses and stories are told about this topic. And, the truth is there is a lot of sensationalism about it.

Therefore, listen to me. If you are an ordinary citizen. Work, study, pay your taxes, and decided to study Bitcoin and cryptocurrencies. Understood its real value and from that moment decided to put 20% or more of your assets into crypto.

Some measures need to be taken. Serious measures. After all, **you are now your bank**. Remember the session: Risk, Return, and Responsibilities.

Best practices for storing your key phrases

1- Always, write down your key phrases with pen and paper. Preferably, write them on 2 different pieces of paper and store them in a location that only you know about. This is easy, cheap, and doesn’t require much explanation.

2 – Divide your key phrases. In a hypothesis of 12 words. You can leave 4 words with your wife/husband, 4 words with your brother, and 4 words with your mother or father as a backup.

Thus, you force all of them to reach a consensus, in the event of your absence, so that everyone can gain access to the funds.

Therefore, if your mother disagrees or suspects your wife. She blocks it. If your brother disagrees with someone, he blocks it. There is no way to move the funds. And so on.

Do you understand how brilliant this is? You no longer have to pay lawyers and notaries a river of money to divide assets. And in the future. Notary offices will migrate to blockchain too. Our life will be even less bureaucratic.

3 – You can schedule an email, with 4 words each. And send it to 3 trusted recipients. Ahhh, but it’s online! Yes! Use 3 different non-KYC email providers and send it off.

Example: Protonmail, Tuta, Forward e-mail

👉More on awesome privacy.

Done. If something happens to you and you need to resolve it quickly. You have three solutions for now. And there is also Nostr. I wrote about it here.

Being decentralized, you can also use the protocol to communicate with someone else.

4 – If you have money left over. Want and can buy a steel plate to store your key phrases. Go ahead! Otherwise, don’t.

We have the expensive cryptosteels, the beautiful metal bars from Trezor and some other options. If you can, do it. Otherwise, focus on accumulating more and more.

X – Never, under any circumstances. Keep the 12 key phrases in any online application such as:

Google Docs, Evernote, Apple Notes, Notion, Trello, Obsidian, and etc. Well, you got the message…

Leaving your key phrases with companies like these is the same as leaving your cryptocurrencies on an exchange. It won’t work! Because they can come and take them from you. Or you can be hacked and also lose them.

In an age of artificial intelligence. Have no doubt that everything that is written digitally is stored and later read by bots and meticulously calculated algorithms to extract the maximum amount of information from you and convert it into sales, ads, and services.

Differences between wallet types – Cold and Hot wallet

Alright then. Suddenly you went from a cryptocurrency enthusiast and lunatic to a serious person. You already understand the system and its ins and outs. Therefore, now it’s time to decide which wallet to use, when to use it, where, and how:

Hot Wallet

In simple terms, this is a wallet that has internet access and, therefore, is considered “hot”🥵. Because it has contact with the internet and can suffer attacks such as phishing1, malware2, and hacks3. (explain each one in footnotes.)

When to use: In your daily life, for small value transactions.

Where to use: Establishments and small value interpersonal transactions.

How to use: When a person or establishment generates a QR code or sends you the destination wallet address. You enter your hot wallet and execute the transaction.

Which to use: You can access the official Bitcoin and Ethereum websites. And, choose the best wallet for you, according to your profile.

I only use Blockstream on my cell phone.

Cold wallet

Now, it’s easy. Because if the hot wallet has internet access. The cold one doesn’t. At least, not all the time.

When I started using Bitcoin. Back in 2017. We used cold wallets generated on the internet. We printed them on paper and stored them. The so-called paper wallet.

Risk, risk, and more risk. Risk of generating wallets for third parties to capitalize on, risk in printing the file and leaving digital traces, and risk of printing and losing the papers.

Looking back. I confirm, we were very lucky. Because we made many mistakes. And, those mistakes could have cost more.

Cold wallets🥶, have this name. Because they stay most of the time and/or all the time without an internet connection. Naturally, when you connect them to the internet. It gets “warmed up“.

However, it requires you to take some action on the physical buttons before concluding any transaction. Whether in the purchase or the sale. This adds an extra layer of protection.

When to use: If you decide to put 20% or more of your assets into cryptocurrencies. It’s time to use one of these “expensive” and “intoxicating” cold wallets for security and storage.

Where to use: Only use them at home or in secure locations where there is no pedestrian traffic and you can calmly handle your funds. Understand that it is now your “safe” and “bank”.

How to use: Take your physical device, insert the cable that comes with it, and connect it to the computer. Use it to carry out your purchases and sales at the wallet addresses pointed out by you.

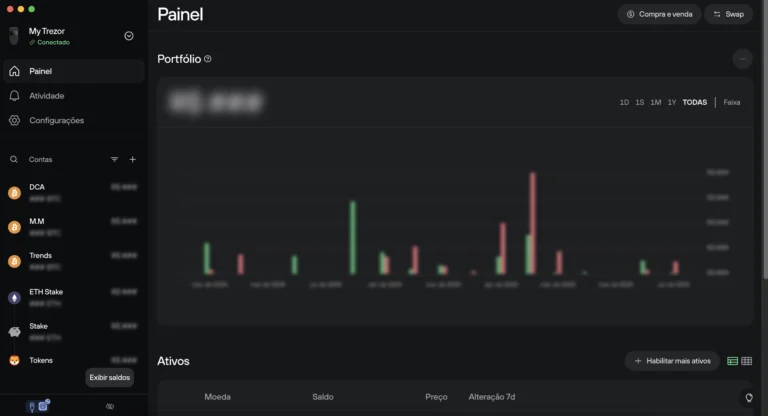

Which to use: Trezor, Ledger, Jade, and Coinkite.

Naturally, there are other ways to have cold wallets. Investing almost little or nothing in a device. However, this requires a lot of knowledge and practice for the user.

If you are reading this tutorial. It is because you have doubts, and therefore, I do not recommend this practice. Yet. However, you can read here the excellent manuals by Jameson Lopp on the subject.

Now, you already know what wallets are. When, where, and which ones to use. Therefore, create a simple plan of how you will transact your cryptocurrencies, how you will back them up, store them, and that’s it!

Go back to studying and working. Your focus must always be to improve yourself and your work. To eventually earn more. Save more and invest more in the long run.

Only then will you achieve your long-awaited financial freedom.

How to use Bitcoin in wallets

First of all, let’s be realistic. As much as the Bitcoiner community and enthusiasts don’t like to admit it. We are far from global and massive adoption. For daily use. However, we are advancing slowly.

Don’t be a rookie, much less an evangelist on the topic. Rationality and staying grounded are necessary.

I would never advise you to put 100% of your assets into these assets. Not even 20%. Right at the start. Why? You need practice and experience. To do it.

If you don’t know the fundamentals of Bitcoin and cryptocurrencies. If you don’t know how to act in certain situations and scenarios. You will sell, yes. It’s about our protection and survival, something that is in our instinct to do. To protect ourselves. In this case, to protect against losses.

I continue to preach: Invest in yourself, in your education, create a business, and pay attention to your sources of income.

When you focus on these topics. You will be able to buy much more crypto than you ever dreamed of. Who do you think can buy more? Someone who receives R$2,000 monthly or someone who receives R$50,000?

I went around all this to get here:

| Asset | Allocation | Where |

| Fixed Income | 40% | Treasury Direct, CDB (Bank Deposit Certificate), and Savings |

| Variable Income | 40% | Stocks, ETFs, and Stocks |

| Businesses | 10% | Some business you participate in or own |

| Cryptocurrencies | 10% | Bitcoin or Ethereum |

I will leave the numbers to everyone’s imagination. This is a classic 80/20 example. Well diversified. In this scenario, I would already invest in a cold wallet.

Assume my assets at this point are around $20,000.

So:

$20,000 * 10% in cryptocurrencies = $2,000

Is that a lot of money? It depends. Everyone has a different reality, and who am I to judge.

Just don’t forget that you worked for this money. Whether it is a lot or a little. It has your time, energy, and effort in it.

No matter how small the amount. I recommend taking part of that money and buying a cold wallet. Of the remaining value. Put 80% in the cold wallet and 20% in the hot wallet.

We need to talk about the news

What sells more? Happiness or tragedy?

Exactly…

Staying updated and informed. Is very different from watching the news every day and/or following the news every hour.

Of everything that happens in the news. What is within your power and control to change?

If you follow the news closely. You will sell at the bottom and buy in time. It seems cliché. But you do it without even noticing. I’ve done it myself many times. Believe me.

What I recommend:

- Use Google Alerts and mark your favorite topic.

- Use Google Trends to find out the latest. Read this here to help you.

- Use Trading Economics to set price alerts.

Most traditional media will do everything they can for a click. So, relax. Most news are clickbaits4 and will not affect your life to that magnitude.

To be honest. The last piece of news that truly impacted my life. Happened in 2020. And we all know what it was…

Avoid trading apps, exchanges, and any type of quotation on your cell phone. Again, I insist. Focus on yourself, on your work, and on your studies. Eventually, start a business where you have expertise.

Dedicate yourself to creating new sources of income. Empower them, save what you can, invest, and put the money to work for you.

This should be your mantra. Avoid FOMO and anxiety in your investments as much as possible.

Taxes, obligations, and government

Well, we all know what the government wants and what it delivers to us in return. However, our only job is to be ordinary, well-behaved citizens.

Pay your taxes, produce, and develop yourself in the country you choose to live in. However, you can and should have more power over your life and your resources.

Use the knowledge contained in this tutorial and the vastness of the internet. To make the decisions that best fit your set of interests.

Pay the minimum amount of taxes possible to live well and avoid declaring your cryptocurrencies to prevent taxation.

The government’s goal is your money and your ignorance. So, you have the obligation and the responsibility to keep it as safe and private as possible. And continue expanding your horizons.

Use your cryptocurrencies and their advantages for your good and that of your family. Sooner or later, you will remember the words contained in these lines.

Thank you very much for making it this far.

Like, comment, or share so that more people are aware of the subject. Mirror the idea.

FAQ

What is self-custody?

Self-custody, in the context of cryptocurrencies, means having exclusive control over your own digital assets.

How to self-custody Bitcoin?

Self-custody Bitcoin means removing your coins from an exchange and storing them in a digital wallet where only you hold the private keys. The process involves three main steps: Obtaining the wallet, setting up the security keys, and transferring the Bitcoin.

Is it worth investing R$1,000 in Bitcoin in 2025?

The decision to invest any amount, especially in a volatile asset like Bitcoin (BTC), depends entirely on your risk profile, time horizon, and financial goals.

Bio

Passionate about investments and the transformation they can bring, the threedolar team is dedicated to demystifying the financial world and guiding its readers toward financial independence. We believe that knowledge

References

https://www.cnbc.com/2022/06/27/three-arrows-capital-crypto-hedge-fund-defaults-on-voyager-loan.html

https://www.sec.gov/enforcement-litigation/litigation-releases/lr-25729

https://www.walletgenerator.com